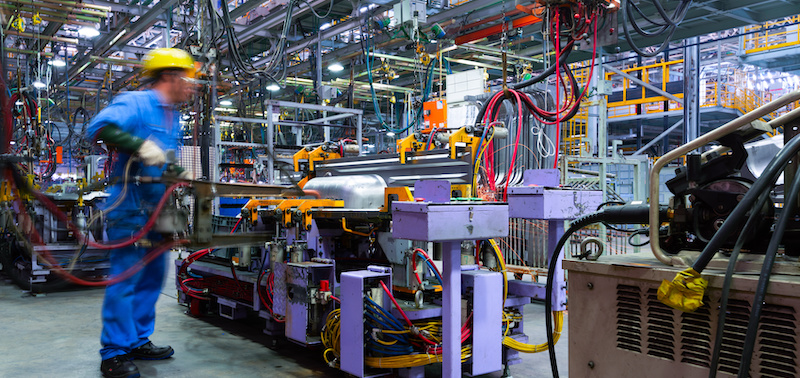

Economic activity in the manufacturing sector declined in November, but the overall economy grew for the seventh consecutive month — after it had dipped significantly in the early stages of the coronavirus — according to the nation’s supply executives in the latest Manufacturing ISM Report on Business.

The November PMI registered 57.5%, down 1.8% from the October reading of 59.3%. This figure still indicates expansion in the overall economy for the seventh month in a row after a contraction in April, which ended a period of 131 consecutive months of growth. The New Orders Index registered 65.1%, down 2.8% from the October reading of 67.9%. The Production Index registered 60.8%, a decrease of 2.2% compared to the October reading of 63%. The Backlog of Orders Index registered 56.9%, 1.2% higher compared to the October reading of 55.7%. The Employment Index returned to contraction territory at 48.4%, 4.8% down from the October reading of 53.2%. The Supplier Deliveries Index registered 61.7%, up 1.2% from the October figure of 60.5%.

The Inventories Index registered 51.2%, 0.7% lower than the October reading of 51.9%. The Prices Index registered 65.4%, down 0.1% compared to the October reading of 65.5%. The New Export Orders Index registered 57.8%, an increase of 2.1% compared to the October reading of 55.7%. The Imports Index registered 55.1%, a 3% decrease from the October reading of 58.1%.

“The manufacturing economy continued its recovery in November,” said Timothy R. Fiore, chair of the Institute for Supply Management Manufacturing Business Survey Committee. “Survey Committee members reported that their companies and suppliers continue to operate in reconfigured factories, but absenteeism, short-term shutdowns to sanitize facilities and difficulties in returning and hiring workers are causing strains that will likely limit future manufacturing growth potential.

Of the 18 manufacturing industries, 16 reported growth in November, in the following order: Apparel, Leather & Allied Products; Nonmetallic Mineral Products; Textile Mills; Wood Products; Electrical Equipment, Appliances & Components; Fabricated Metal Products; Plastics & Rubber Products; Primary Metals; Chemical Products; Machinery; Computer & Electronic Products; Paper Products; Miscellaneous Manufacturing; Transportation Equipment; Furniture & Related Products; and Food, Beverage & Tobacco Products. The two industries reporting contraction in November are: Printing & Related Support Activities; and Petroleum & Coal Products.

Related Posts

-

The October PMI registered 59.3%, an increase of 3.9% from the September reading of 55.4%…

-

The August PMI registered 56%, an increase of 1.8% from the July reading of 54.2%—…

-

The August PMI registered 55.4%, a decrease of 0.6% from the August reading of 56%…